Month: December 2017

Cryptocurrency Trading: 3 Things You Must Do to Be A Successful Bitcoin Trader

The inexperienced and undisciplined cryptocurrency trader is virtually guaranteed to lose money over the long term. But you don’t have to lose your money trading…

Honest Markets.com Cryptocurrency Trading Broker Review

Honest Markets.com Review Markets.com is an international Cryptocurrency broker formed in 2006. They are licensed and regulated by the CySEC in Cyprus, as well as…

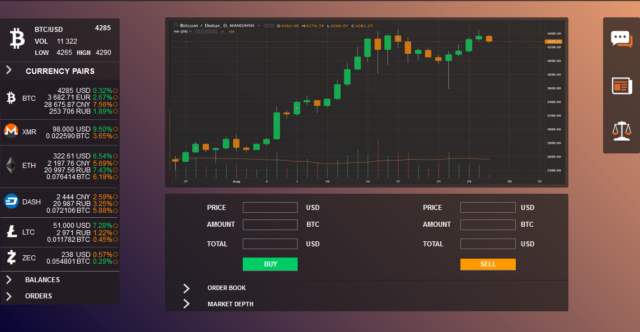

Cryptocurrency Exchange Trading: All About Day Trading Cryptocurrency

In short, day trading cryptocurrency is defined as buying or short selling a cryptocurrency, and then closing that position within a single trading day, usually…

For the Noobs: Why You Should Only Buy Cryptocurrency With a Major Credit Card

In this post we will be explaining why we think you should only buy cryptocurrency with a major credit card such as Visa or Mastercard…

Cryptocoin Stock Exchange produces top quality brand exposure for digital currency and blockchain companies and firms. We provide exposure for hundreds of companies and you can be one of those companies. Our clients always appreciate our value and prices. Contact us if you have any questions at our email cryptocoinstockexchange@gmail.com. Cryptos and Digital tokens are highly volatile and risky. You must conduct your own research before making any investment decisions. Some of the articles on this blog are guest posts or paid posts that are not written by our authors (namely Native Voices content) and the views expressed in these types of posts do not reflect the views of this website. Cryptocoin Stock Exchange is not responsible for the content, accuracy, quality, advertising, products or any other content posted on the site.

Recent User Comments